In the world of financial analysis, talking about “performance” is like talking about the weather: everyone does it, but few really understand it. The return on a portfolio is often perceived as a single number, a final figure that summarizes months, sometimes years, of movements, strategies, and fluctuations. But those who work in financial consulting methodically know that the final number is not enough. It is necessary to break it down, understand it, and measure it. You need to go inside the black box of performance. And performance contribution is the tool that allows you to do this with scientific precision.

Differences between contribution and attribution

Although Anglo-Saxon literature often confuses them, contribution and attribution are profoundly different tools.

Attribution is the offspring of theory, designed to assess deviation from a benchmark. It is the main tool of active delegated management, where performance is broken down into asset allocation choices, stock selection, and market timing.

Contribution, on the other hand, is much more concrete. It does not assess how good the manager was, but how much each component of the portfolio weighed on the final result, in real terms. It is, in short, an ex post analysis that captures actual contributions, even in the absence of benchmarks, and is therefore perfect for personalized advice.

Why regulation is pushing in this direction

In recent years, regulation has raised the bar. The horizon set by MiFID II and subsequent regulatory additions pushes toward accurate, transparent, and verifiable reporting.

In this context, performance contribution becomes a de facto standard. It is not a quantitative quirk, it is a professional necessity. And it is precisely in this scenario that advanced tools such as FIDAworkstation show their value.

What the performance contribution module in FIDAworkstation really does

Within the FIDAworkstation platform, the module dedicated to contribution allows for an analytical and detailed breakdown of overall performance.

The analysis is developed on three levels:

- Personal data and composition: identification of securities in the portfolio

- Movements and flows: initial and final values, flows collected, average price

- Statistics and performance metrics: the quantitative heart of the analysis

Total profit and capital gain

- Total profit represents the overall monetary gain (or loss) associated with a security.

- Capital gains are the “pure” gains from capital appreciation, net of flows.

MWRR and TWRR explained

- MWRR (Money Weighted Rate of Return) is a return weighted by cash flows. It takes into account the timing of payments and withdrawals

It is the return “experienced” by the customer.

- TWRR (Time Weighted Rate of Return), on the other hand, is neutral with respect to cash flows and reflects the pure performance of the portfolio.

Both measures are calculated on the platform, with total and annualized returns.

Total return, average annual return, volatility

- Total return is the percentage change in the value of the security over the period.

- The average annual return is calculated as a compound return, which is useful for standardized comparisons.

- Annualized volatility is a measure of implied risk: the higher it is, the more erratic the asset’s behavior.

High volatility is not necessarily negative, but it must be interpreted.

Contribution to performance as a percentage

The key metric is performance contribution %. It is calculated as:

Perf. Contribution % = (Security profit / Portfolio profit) *100

It isolates the actual drivers of performance. Not just who earned, but who had an impact.

How to read a contribution analysis

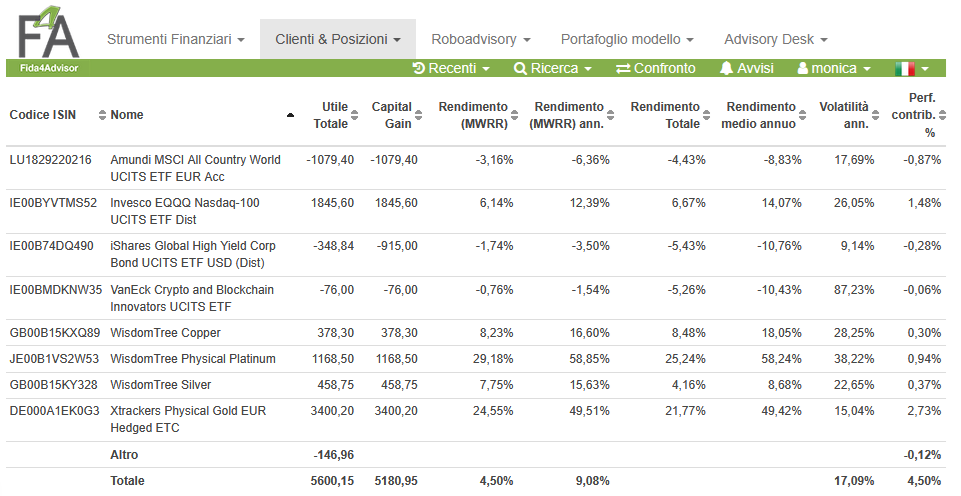

A practical example from FIDAworkstation:

Source: FIDAworkstation

- The hedged gold ETF generated a profit of +€3,400, with MWRR +24.55% and contribution +2.73%. Portfolio driver.

- The crypto sector had a minimal impact but very high volatility (87%). Expose with caution.

- The Nasdaq ETF made a good positive contribution (+1.48%), signaling the strength of the growth component.

The analysis allows the advisor to communicate clearly and numerically with the client, enhancing data-driven advice.

Where numbers and decisions meet

In a context where financial advice must become increasingly scientific, documented, and transparent, performance contribution is not an optional exercise: it is a distinctive skill. It is not just a matter of reporting, but of thoroughly understanding the dynamics of the portfolio, isolating latent risks, validating the choices made, and providing narratives based on numbers.

Tools such as FIDAworkstation offer professionals what they need to tackle this challenge with rigor and authority. Because it is not enough to say that the portfolio has performed well. It is necessary to demonstrate who has performed well, how, and why.

Monica F. Zerbinati

Request a free trial at welcometeam@fidaonline.com